How the Beauty Industry is being disrupted by indie brands

An industry once dominated by big CPGs increasingly tilts towards indie brands.

One interesting trend I noticed when running a DTC cosmetics brand was the affinity of big CPGs to acquire new brands rather than building new brands themselves. The graphic below shows just how vast the portfolios of these big beauty conglomerates are — most of which have been captured via acquisition.

However, over recent years the traditional beauty market dynamics have been upended. Digitally native brands can now easily reach consumers via social media and no longer need to ink retail partnerships to build traction. The success of Dollar Shave Club, Harry’s and Glossier, among many others, reflects the scale of disruption these brands can cause.

The rise of Gen-Zs only serves to exacerbate this shift. As a generation, they prefer DTC over legacy brands by 40–45% compared to Millennials at only 4%. Importantly, this generation has grown up in the digital age with access to a wealth of information, and they increasingly demand authentic, value-driven brands where sustainability, diversity and inclusion rank highly. This behavioural shift will have significant ramifications on the beauty industry as this generation ages and continues to gain purchasing power.

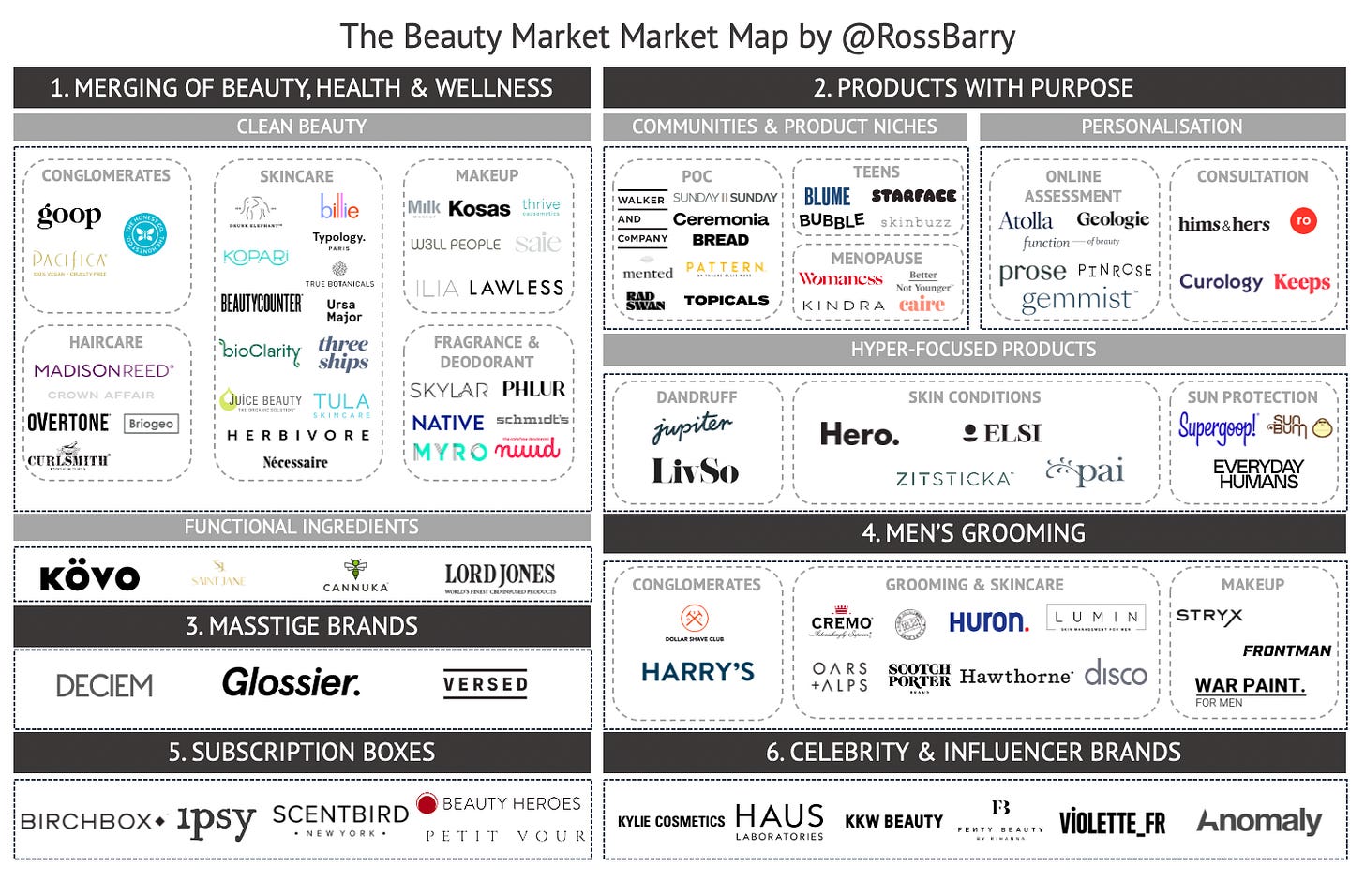

Normally, takes on the beauty industry tend to be focused on product verticals such as skincare or haircare. However, trends in the industry capturing both consumer and investor attention transcend verticals. I think a more useful way to draw out the key players is via a trend-driven market map — assessing which trends will drive investment going forwards.

There are some excellent resources on the space already, which I would recommend diving into — Glossy, WWD, Business of Fashion and Beauty Independent, to name but a few. I’ve also been inspired by my friend Pietro Invernizzi’s deep dives into the SaaS world.

Startups

A few disclaimers to begin with on how I put this market mapping together:

The focus of this article is primarily on mapping beauty startups across trends rather than by category (e.g. haircare). I find this more interesting from an investment perspective as it helps differentiate standouts from the crowd.

I’ve made some exclusions from this market map to narrow down the focus. Specifically, it does not include Oral Care, Supplements, Beauty Tech, or Feminine Care. The reason I’ve chosen to omit these verticals specifically is that I believe they have enough depth to warrant their own market map (which I may dive into in a later post).

Many brands sit across multiple categories or trends. I’ve chosen one category per brand in an effort to simplify.

As always, there will be some brands that have not been included. I’ve tried to focus on brands with significant traction or funding. However, please DM me on Twitter if I’ve missed any key ones!

For a full list of >200 beauty brands including investment and investors, check out this Notion table here. Note: You might need to scroll down and wait for all brands to load.

1. The merging of beauty, health and wellness

Consumers are increasingly aware that beauty, health, and wellness have overlapping benefits, which has led to a pronounced shift in consumer behaviour. We now look for brands that don’t just look good but fit the better-for-you label as well.

Clean Beauty

As consumers become increasingly aware of the intersection of beauty and health, they are turning to education to better understand what they consume (beauty products included). Clean beauty continues to capture consumer attention, driven by two catalysts:

Consumers face less friction in understanding and scrutinising product ingredients, guided by educational and content platforms such as Think Dirty and Goop.

The inclusion of clean beauty aisles in traditional beauty retailers such as Sephora coupled with the rising popularity of clean beauty retailers such as Credo Beauty and Follain.

Large incumbents have been slow to adapt to this trend given the complexity and expense of reformulating their products to carry the ‘clean’ label. As a result, a number of brands have built large businesses in what was a vacant space. Notable brands:

Clean ‘conglomerates’: Goop, The Honest Co

Haircare: Madison Reed, Crown Affair, Susteau, Curlsmith

Skincare: Drunk Elephant, Billie*, Beauty Counter, True Botanicals, Kopari, Three Ships Beauty, Juice Beauty

Makeup: Milk Makeup, Kosas, Thrive Causemetics

Deodorant: Schmidt’s Naturals, Native, Wild

*Initially focused on women’s shaving products.

Inclusion of functional ingredients

An increasing number of brands have started to include functional ingredients — such as CBD or adaptogens. Whilst their inclusion offers skincare benefits (for instance, CBD can reduce skin inflammation), they also act as a wellness ingredient, merging the line between skincare and general health. Notable examples include Kovo Essentials, Saint Jane, Cannuka and Lord Jones

However, the explosion of brands selling “clean” formulations and functional ingredients has saturated the market. This creates some consumer ambiguity as to which brands are truly effective, especially as there is no real definition as to what “clean” products really mean. Winners in this category will seek to differentiate themselves from the crowd through clinically proven results — offering not only better-for-you formulations but with proven benefits.

2. Products with purpose

The traditional one-size-fits-all strategy used by both large CPGs and DTC brands has started to face ‘unbundling’ as brands look to carve out specific niches within the beauty market.

Communities & Product Niches

Brands are now catering to specific communities that have historically been underserved by big beauty brands. This strategy lends itself to building a community-led brand aesthetic whilst ensuring products serve the key concerns that are often unique to a demographic. In turn, this can generate a loyal customer base that brands can tap into to guide future product development.

There are many that could fit these classifications, but I will list a few which already have considerable traction.

People of Colour: Whilst big brands continue to retrospectively add diversity to their brands (which have historically wrongly catered more to white consumers), several independent brands have entered this space to serve specific demographics :

Skincare & Makeup: Walker & Co, Topicals, Mented Cosmetics

Haircare:

Textured Hair: Pattern Beauty, Sunday II Sunday, Bread Beauty Supply

Latinx: Ceremonia

Age demographics: Brands now look to specific age demographics which have unique needs where current options are often stale and uninspiring. It’s no easy task — on top of developing products unique to an age demographic, brands have to ensure their messaging across marketing channels resonates with their audience. For instance, several brands believe that educational content is integral to their offering — becoming a voice to help consumers understand their body needs as they go through phases such as puberty or menopause.

- Teens: Blume, Starface, Bubble and SkinBuzz take a holistic approach to teen beauty. These brands seek to provide an authentic voice that Gen-Zs can identify with, providing both products and content which helps consumers understand the changes to their body as they go through puberty

- Menopause: Womaness, Better Not Younger, Kindra, and Caire capitalise on the inclusive beauty trend, aiming to destigmatise menopause. Like the Teen market, brands seek to open the conversation — in this case around menopause, whilst providing specific products often neglected by big CPGs.

Personalisation

Some brands go a step further, using personalisation to create specially formulated products for consumers.

Online Assessments: One branch of startups in this subcategory uses online assessments to gauge not only the hair and skin types of consumers but also qualitative factors, such as the climate they live in. This assessment results in an almost unique product — for instance, one skincare brand has up to 3 billion formulations available.

Whilst personalised products generally live in the online domain, Function of Beauty’s recent partnership with Target demonstrates how this model is adaptable to retail stores — enabling brands to build an omnichannel strategy.

Notable examples:

Consultations: Another strategy is to use online consultations (e.g. with a dermatologist) to understand what products are right for you. Pioneers in this sector, such as Ro, initially built the model around erectile dysfunction before moving into other prescription-based products, which also require a consultation. Notable examples include (only beauty products stated) include

Multi-product offering: Ro, Hims & Hers

Skincare: Curology

Hair loss: Keeps

The benefit from both online assessments and consultation based products, aside from the greater consumer affinity generated through personalisation, is the data they can develop and utilise to inform future product releases.

Hyper-focused products

The final grouping in this trend are hyper-focused products, which hone in on a specific skin condition or vertical whilst being one-size-fits-all across ages and demographics. Like other categories, this enables them to utilise their effectiveness (e.g. acne products that noticeably reduce or removes acne) to expand into other complementary products — with the goal to capture as much of a consumer’s beauty regimen as possible. Notable examples:

Acne: Zitsticka, Hero Cosmetics

Sensitive Skin: Pai, ELSI Beauty

Sun Protection: Supergoop!, Sun Bum, Everyday Human

3. Masstige Brands:

Large CPGs have not evolved from the traditional bifurcated view of the market — that products either sit in mass or luxury divisions with no middle ground. In reality, “masstige” brands have upended this dynamic with products that offer the same benefits and ingredients as prestige brands but which are much more affordable.

Brands in the masstige segment have built a results-driven attitude, often including attributes reserved for the luxe end of the market — such as clean, sustainability or the inclusion of wellness ingredients. This segment has broad appeal, both to:

Those that want to get more bang for their buck with the same results (i.e. spend less)

Those who would ordinarily buy drug-store priced products but are willing to spend a little more to get better quality, well-branded products (i.e. spend more)

Notable brands:

Opportunities lie within other analogous beauty verticals, which are still primarily split between mass and luxe price points where brands can capitalise on a masstige strategy. Haircare, for instance, has room to mature and follow the success of skincare brands in this segment.

4. Men’s Grooming

Men have historically been a low-spending category for beauty, primarily attributed to the entrenched stigma surrounding the use of anything other than shaving products. However, several catalysts are now crystallising, and the men’s personal care market size is expected to reach $166bn by 2022.

There have, of course, already been successes in the industry — Dollar Shave Club and Harry’s are prominent examples. These brands initially focused on a grooming staple with no stigma attached (shaving), enabling them to capture loyal customers and upsell them into complementary products over time. Harry’s, for instance, has evolved from shaving products to include skincare, bodycare and haircare products.

However, Millennials and Gen-Zs are much more willing to use beauty products, and as they continue to gain buying power, the men’s market is expanding significantly. Younger men, for instance, are more willing to educate themselves on skincare, engage in multi-step grooming regimens, and, in general, be less cautious of the perceived ‘masculinity’ of the products they use. This openness has given rise to several gender-neutral skincare and men’s makeup brands. The reality of this shift is seen by CVS’s recently announced listing of men’s makeup brand Stryx in 2,000 stores.

Notable startups:

Conglomerates: Dollar Shave Club, Harry’s

Grooming & Skincare: Huron, Lumin, Scotch Porter, Disco, Hawthorne

5. Subscription

Subscription boxes can be an attractive source of recurring revenue, especially when coupled with other revenue streams, such as converting users to product sales on proprietary e-commerce sites. However, the success of these models depends on generating workable unit economics — customer acquisition costs need to be delicately balanced off against potentially high subscriber churn rates (not limited to the beauty industry alone).

Whilst Birchbox reflects some of these difficulties, others such as Ipsy or Scentbird have been much more successful in scaling their model, catering to an audience who look to discover new products. Some providers are now honing in on hyper-focused niches, such as those around clean beauty.

Fragrance: Scentbird

Clean Beauty: Beauty Heroes, Petit Vour

A play that is becoming commonplace across consumer verticals is tapping into a subscription model for general products, boosting LTV in an environment of rising customer acquisition costs. In beauty, this was perhaps first proven by the likes of Dollar Shave Club but has now become a semi-conventional option at checkout.

6. Celebrity & Influencer Brands:

As celebrities continue to shift to founder rather than paid endorser, the beauty industry has witnessed an explosion in celebrity-led brands. When done well, these brands can capitalise on a major following by converting them into not just customers but brand advocates via user-generated content.

Notable brands:

Kylie Cosmetics, Fenty Beauty by Rihanna, KKW Beauty (Kim Kardashian), Haus Laboratories (Lady Gaga), Anomaly (Priyanka Chopra Jonas)

However, whilst there is no doubt this is an effective strategy (as evidenced by Coty’s $600m purchase of a majority stake in Kylie Cosmetics), the success of these brands is intertwined with the celebrity, which may hinder longevity (e.g. if there is bad celebrity PR).

Exits

DTC founders often look to acquisitions as their ultimate exit strategy, with strategics behind some of the most notable exits in the industry.

Their acquisitive nature comes with good reason: large CPGs need to ensure they gain exposure to emerging trends and audiences, particularly Gen-Zs. These strategics can also quickly scale acquired brands, generating revenue synergies as they turn on distribution across retailers.

However, the risk of regulatory powers scrutinising large DTC acquisitions is growing. This is evidenced by the failed acquisitions of Harry’s and Billie by Edgewell and P&G, respectively, owing to FTC involvement. As a result, big beauty brands may be forced to seek acquisitions earlier in the startup lifecycle — removing a potential exit strategy for larger brands.

However, other exit playbooks exist. Among these include receptive private equity (PE) firms that can engage in roll-up plays to generate synergies between brands. SPACs are also on the rise — and those which are thematically focused look to rival the big beauty conglomerates through acquiring attractive assets. For standout successes, the IPO option is on the table, with the likes of Glossier, Harry’s and The Honest Co. all rumoured to be assessing an entry to the public markets.

Investors

If you’re a founder in the space, I’ve listed out some of the investors who are frequent investors in the space (not including angels).

You can also check out my Notion table, which lists out the investors (where publicly available) for each mapped brand. Note: You might need to scroll down and wait for all brands to load.

VCs

Most VC funds who are active in the consumer sector will have some exposure to the beauty industry, driven by the standout exits over the past ten years. These include Lerer Hippeau, Imaginary Ventures, Lightspeed General Partners, Silas Capital, Forerunner Ventures, Centre Street Partners, BBG Ventures, Color Capital, etc. At the later stage are the likes of L Catterton and JMK Consumer Growth.

Corporate Investors

A number of CPGs now have their own venture funds which seek to participate in funding rounds alongside VCs:

Unilever Ventures is most active in the space, having invested in Kopari, Womaness and Zitsticka, amongst others.

At the growth stage, stage, LVMH is active through L Catterton, including investments in Function of Beauty, The Honest Co and Tula.

A number of other CPGs, including Johnson & Johnson, Colgate Palmolive and L’Oreal, also have their own funds but have seen less activity.

It’s also worth noting that several CPGs have exposure to the market through accelerator programmes, such as L’Oreal’s partnership with Founders Factory or Sephora’s Accelerate programme.

Final Thoughts

Taking a step back, the trend that can be seen across consumer verticals are rapidly rising customer acquisition costs. This is a function of more brands than ever before fighting for online traffic, which has become increasingly valuable given the high propensity of consumers to shop online, owing to the pandemic. The immediate takeaway is that it pays to adopt an omnichannel strategy with exposure to retail formats such as Target — but this holds true across most consumer verticals.

The true winners in this market will be those who can generate attractive user economics. In short, this comes down to average order value (AOV) coupled with customer loyalty. It’s hard to see this working in some verticals where there are just so many brands competing without a clear differentiator.

Those that succeed will tap into communities, personalise products or build around a specific customer problem (e.g. acne) to generate a loyal following. This ‘loyalty’ means both repeat customers over time as well as loyalty to their product range (i.e. consumers buying more of their beauty regimen from one brand rather than several brands).

There are clear leaders in some verticals already (e.g. for POC, or for age demographics) who can now start to use their initial traction as a springboard to expand into other verticals. They have also lit the way for more brands to continue to find and carve out other niches in the beauty market.

That’s not to say there will not be standout successes in other categories. There are plenty of brands that will win consumer attention and find solid exits. But if the ambition is to find the next Glossier, brands need to cultivate a following — a difficult task given the saturation seen in most beauty verticals.